India Digital Health Gold Rush: Why 2025 is Breakout Year for Health-Tech Startups (AI, Funding, Telemedicine)

TL;DR - India Digital Health Gold Rush 2025

• Who it's for: Entrepreneurs, investors, health-tech founders, and industry observers analyzing India's digital health opportunity

• Main outcomes: $1.13B invested in 2024, massive government policy support, 340M+ telemedicine consultations, AI healthcare boom

• Key trends: ABDM digital health infrastructure, GST tax cuts for health-tech, rapid consumer adoption, AI-driven solutions

• Timeframe: 2025 is the breakout year, peak growth phase 2025-2027, market maturation by 2028-2030

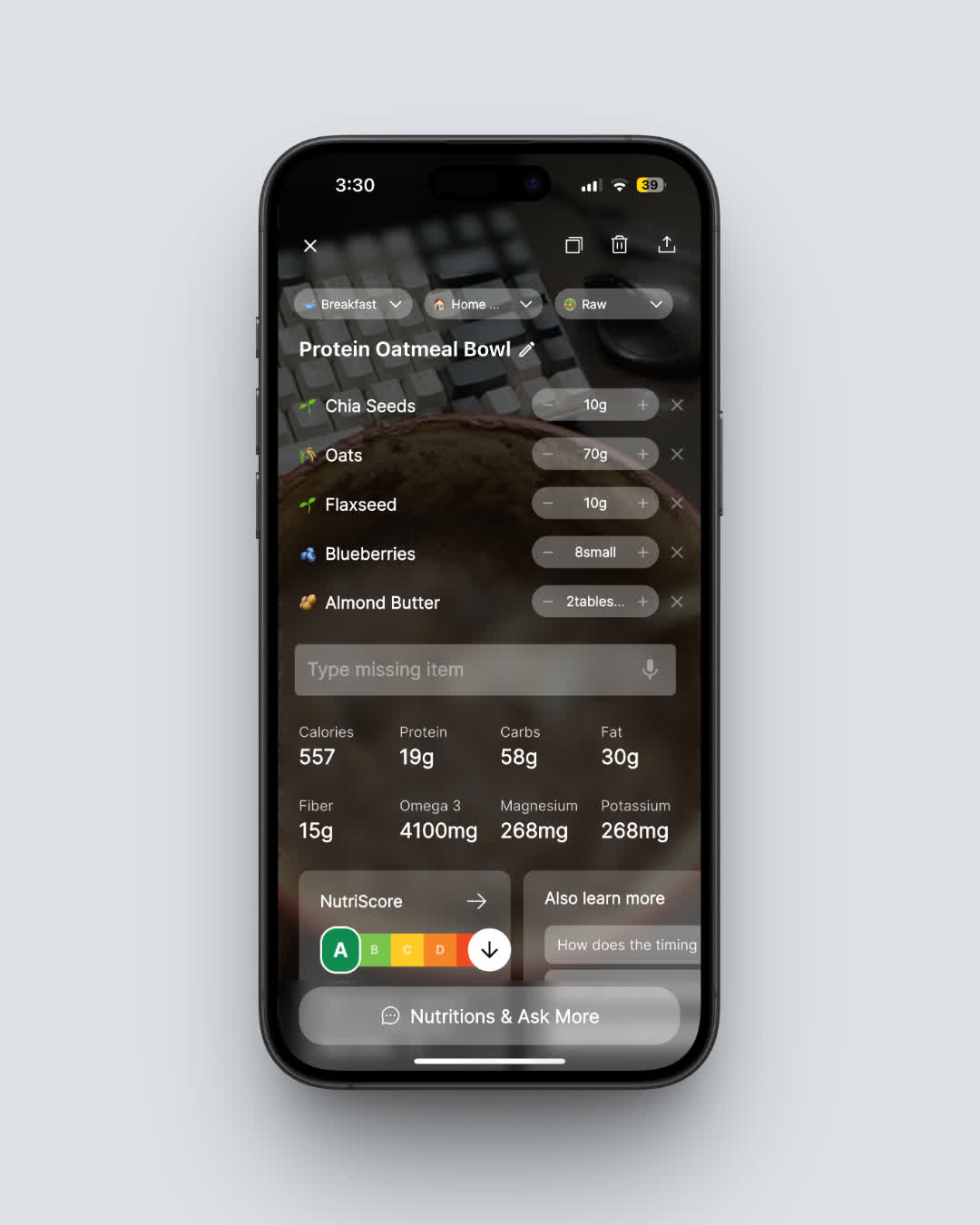

• Opportunities: Telemedicine platforms, AI diagnostics, remote monitoring, nutrition apps like NutriScan's approach, chronic disease management

Ever wondered why investors in Indian health-tech, doctors, and even your gym buddy can't stop talking about digital health startups in India this year? I've spent two years building health and fitness products, and the energy for India digital health innovation I feel right now is louder than any past cycle. Step by step, let me show you why 2025 is not just another calendar page but the tipping point for digital-health startups in India, especially those focusing on AI wellness solutions and remote patient monitoring.

Why Everyone's Buzzing About Digital Health in India for 2025 🤔

The convergence of technology, policy, and market demand has created an unprecedented opportunity for health-tech innovation in India. From massive funding rounds to government policy support, every indicator points to 2025 being the breakout year for digital health solutions.

The Three Big Forces Powering India's 2025 Health-Tech Boom 🚀

Health-Tech Funding India: Money is Flowing Again 💰

- Indian health-tech startups raised a whopping US $1.13 billion across 112 deals in 2024, a sharp rebound for venture capital in health-tech India after the 2023 slump.

- Q1 2025 alone saw US $496 million pour into the Indian health technology sector across 38 rounds, signaling strong investor confidence in digital health India.

- AI in healthcare India attracted significant attention, with AI-focused health firms securing US $560 million in new capital last year. This shows big interest in AI-driven health solutions.

Policy Wind: Government Backing for Digital Health India 🌬️

- The Ayushman Bharat Digital Mission (ABDM) is a game-changer, already issuing hundreds of millions of digital health accounts (ABHA IDs), giving health-tech startups in India ready rails for secure health data exchange.

- Draft tax rules aim to cut GST on remote-care devices and telemedicine technology, trimming operational burn for hardware-enabled platforms focusing on remote diagnostics India.

- Faster ABDM sandbox approval means most startups can finish API onboarding in under a week, speeding up digital health platform integration.

Consumer Adoption: Indians Embrace Online Health & Telemedicine 📱

- Government tele-medicine service e-Sanjeevani has impressively handled more than 340 million consultations, proving high telemedicine adoption in India. This massive adoption creates opportunities for specialized nutrition apps like NutriScan's AI-powered meal tracking to integrate with broader health ecosystems.

- India's tele-health market size could jump to US $10.7 billion by 2028 (growing at ≈28% CAGR), a huge opportunity for online doctor consultation platforms.

- Around 77 million Indian adults already live with diabetes, significantly pushing demand for digital diet management apps, chronic care platforms India, and tools like NutriScan App for AI nutrition analysis.

Real-World Examples: Indian Health-Tech Startups to Watch in 2025

| Segment | Startup Example | What they solve | Traction Snapshot |

|---|---|---|---|

| Tele-health Platforms India | Practo | Video visits for 50+ specialties, online medical consultations | 30 million consults/year |

| AI Nutrition Tech India | NutriScan App | Photo-based AI meal analysis, personalized diet plans India | Over 12,000 meals scanned (as of May 2025) |

| Remote Diagnostics Solutions | Aarogyam Labs | At-home blood test kits + IoT reader for health monitoring devices | 500k kits shipped |

| AI Wellness Coach Apps | HealthPlix | GPT-style AI lifestyle coach for Indian users, EMR solutions | Used by 10k doctors |

| Chronic Disease Management India | BeatO | Phone-linked glucometer + coach for digital diabetes care | 800k active users |

Key Data for Health-Tech Founders in India 📊

- Early-stage rounds made up ≈64% of all 2024 health-tech deals in India, proving VCs still bet on new health-tech entrepreneurs.

- AI diagnostics India revenue could triple by 2030, led by medical imaging AI and AI in cardiology.

- Tele-medicine guidelines India let doctors treat patients nationwide, cutting travel cost by up to 80% and improving access to specialist healthcare online.

- The Indian government aims to place 75 million people with diabetes or hypertension on digital care programs by 2025, boosting the market for chronic management apps.

My Hard-Earned Tips for Building Successful Digital Health Startups in India 💡

Focus and Integration Strategies

- Solve One Specific Health Pain First. Start narrow-maybe online repeat prescriptions for thyroid patients in India-before chasing a full digital clinic suite.

- Integrate with ABDM Early. ABDM compliance for startups now saves you headaches and builds trust in health data sharing later.

- Marry Hardware with SaaS for Health Monitoring. Cheap wearable health sensors plus rich health analytics software keep users loyal to your IoT healthcare solutions India.

User Experience and Adoption

- Deliver Clear Actions, Not Just Data Hoarding. People share health records online if you return valuable insights like AI meal recommendations, dosage alerts, or personalized fitness goals.

- Keep Doctors in the Loop for Your Health-Tech Platform. AI can triage, but a trusted physician drives adoption of digital therapeutics India. Doctor consultation platforms need their buy-in.

- Use Local Indian Languages for Wider Reach. Voice and chat in regional Indian scripts boost retention for mHealth apps India outside metros.

Business Model and Scaling

- Earn by Outcomes: Value-Based Healthcare Models. Insurers reward HbA1c drop from your diabetes management app, not just app opens. Focus on measurable health outcomes.

- Pilot Your Health-Tech Solution in Tier-II Cities. Lower customer acquisition cost for startups and a bigger growth runway exist for digital health solutions in Tier-2 India.

Step-by-Step Guide: Ride the 2025 India Digital Health Wave 🌊

Phase 1: Foundation (Weeks 1-4)

- Pick a Focus Area in Indian Healthcare. Diet and nutrition tech India, mental wellness apps, remote patient diagnostics-choose based on unmet Indian healthcare needs.

- Validate with Real Users. Spend a week shadowing potential users of your health mobile app.

- Prototype Fast (2 Weeks Max). Use no-code for health software development, off-the-shelf sensors for medical device prototypes.

Phase 2: Integration and Testing (Weeks 5-8)

- Integrate ABDM Sandbox. Test ABHA ID integration and mock health record exchange to prove ABDM compatibility.

- Pilot in One Clinic or Small Community. Offer free licenses of your health management platform for feedback.

- Track Your North-Star Metric Relentlessly. Maybe diet photos scanned per user per week for an AI nutrition app like NutriScan, or average HbA1c change for a diabetes app.

Phase 3: Growth and Scaling (Months 3-6)

- Secure Seed Funding for Your Health-Tech Startup. Show metric trends, not just slides, to health-tech investors India.

- Complete Compliance Checklist for Health Data. ISO 27001, data privacy India (DPDP Act), consent flows, GST for your digital health company.

- Scale Through Strategic Channel Partners. Health insurance companies India, gyms, corporate HR wellness programs can expand your reach.

- Stay Lean and Agile. Outsource medical hardware manufacturing, use pay-as-you-go cloud for health data storage, automate customer support for your online health service.

What Recent Studies Reveal About India's Health-Tech Landscape 📊

- Rural tele-medicine users save about ₹900 in travel and lost wages per online doctor visit.

- Doctors using tele-health solutions in India weekly jumped from 20% pre-2020 to 72% today, showing massive physician adoption of telemedicine.

- Wearable medical devices market in India could hit US $4.2 billion by 2033.

- AI in Indian healthcare market might touch US $8.7 billion by 2030-a staggering 40% CAGR, highlighting investment in AI health India.

- Diabetes cases in India could cross 100 million by 2030 without effective digital care and prevention programs.

Latest 2025 Trends in Indian Health-Tech I'm Tracking 📈

| Trend | Snapshot for Indian Health-Tech 2025 | Why You Should Care |

|---|---|---|

| Health-Tech Funding Momentum | Q1 2025 health-tech investment India raised US $496 million | Capital is ready for health startups India with clear unit economics |

| Generative AI in Health Production | 28% of life-science firms already live with Gen-AI; 48% to deploy within a year | Auto-notes for doctors and Hindi AI chatbots for healthcare cut costs fast |

| Wearables Join the Care Team | ECG rings under ₹5k launching this year in India | Co-branding affordable health wearables India lets you focus on AI insights |

| ABDM as Default Rail for Health Data | ABDM API integration now < 1 week | Easy secure health record exchange boosts user trust and interoperability in healthcare |

| Budget Push for Made-in-India Medical Devices | Tariff tweaks expected for local medical device manufacturing | Local OEM deals can lift your margin overnight for medical hardware startups |

| Hybrid Care Models in Tier-II Towns | Home kits + telemedicine in Tier-2 India cut readmission by 22% in early pilots | Cheaper gear + 4G enables suburban scale for accessible healthcare solutions |

My Top Recommendations for Health-Tech Founders in 2025 🎯

- Integrate Generative AI Early. Even a tiny AI medical scribe tool cuts doctor burn-out.

- Tag All Health Data with ABHA Number. Give users one unified timeline for every digital health record via ABDM.

- Partner on Medical Hardware. White-label health monitoring wearables free you to build the AI health analytics layer.

- Watch India Tariff News Daily. A sudden duty cut on imported sensors can significantly lift your health-tech product margin.

- Pilot Your Digital Health App Outside Metros. Cost per user acquisition (CPA) can be 40% lower in Tier-II cities in India for new health startups.

My Health-Tech India Forecast Sheet to 2030 🔮

| Segment | 2024 Market Size (India) | 2030 Forecast (India) | CAGR |

|---|---|---|---|

| Digital Health Market India (Overall) | US $14.3B | US $52.4B | 24.4% |

| Tele-medicine Market India | US $4.0B | US $15.1B | 20.7% |

| AI in Healthcare Market India | US $0.76B | US $8.7B | 41.8% |

| Wearable Medical Devices India | US $1.04B | US $4.2B (2033) | 15.5%* |

| Remote Patient Monitoring Market India | - (nascent) | US $0.69B | 21.2%* |

*CAGR calculated over the available forecast window.

Inspiring Case Studies: Learning from India's Health-Tech Leaders 🎓

| Startup / Pilot | Focus Area | 2024-25 Data & Insights | Lesson for New Health-Tech Ventures |

|---|---|---|---|

| Practo | Online Doctor Consultations India | 4× jump in visits since 2019; 20k+ doctors | Build supply (doctors) before heavy marketing for your telehealth platform |

| BeatO | Digital Diabetes Management Program | HbA1c down 2.16% in 3 months | Show clinical outcome improvement, not just app opens, to prove digital therapeutic efficacy |

| Apollo 24/7 | Online Pharmacy & Lab Tests India | 19-minute drug delivery in four metros | Speed and efficient healthcare delivery become the moat |

| Cult.fit | Fitness & Wellness Platform India | FY24 revenue ₹927 crore (↑33%) | Diversified revenue streams in health-tech buffer risk |

| Home RPM Pilot | Post-Discharge Remote Patient Monitoring | 75% fewer clinic visits, 97% patient happiness | Simple IoT health devices + daily chat save hospitals money and improve patient experience |

Five Key Take-Home Points for Indian Health-Tech Success 🗝️

- Outcome Over Features. BeatO wins by lowering blood sugar with its diabetes care app, not by a flashy device.

- Speed Sells in Healthcare Delivery. Apollo's 19-minute medicine delivery promise beats coupons.

- Tight Care Circles & Human Nudge. Remote patient monitoring India works when someone (human or AI) nudges the patient daily. Patient engagement in digital health is key.

- Smart Bundling of Health Services. Cult.fit pairs offline gyms with online fitness sessions and nutrition advice.

- Data Trust is Gold in Health-Tech. Practo's growth followed robust health data privacy controls for both patients and doctors. Adhere to DPDP Act India.

Future Roadmap: Guesses for Indian Digital Health 2026-30 🛣️

- Voice + Gen-AI Triage in Multiple Indian Languages will answer first-line health questions. Think AI doctor app in Hindi, Tamil, Bengali.

- ABDM Micro-Payments for Data Sharing may reward each verified data push from wearable health devices-new revenue for RPM apps.

- Risk-Based Health Insurance Pricing: Users with steady diet logs from apps like NutriScan could get up to 15% lower premiums.

- Affordable Home Lab Tests in India may push a lipid panel under ₹200 thanks to low-cost IoT diagnostic strips.

- Cross-Border Telemedicine Growth: NRIs pay in USD for India-based specialists via international telemedicine platforms, adding new inflow.

What I'm Doing Next at NutriScan (Maybe You Can Too!) 🚀

NutriScan's detailed nutrition analysis provides actionable insights for better health decisions

NutriScan's detailed nutrition analysis provides actionable insights for better health decisions

- One-Tap "Share to ABHA" Feature in NutriScan. Every NutriScan meal report will sync in seconds with user's ABHA health locker.

- Pilot RPM Bundle with NutriScan. BP cuff + weight scale + our AI meal coach with a Navi Mumbai cardiac clinic. Combining nutrition AI with cardiac remote monitoring.

- Monitor India Tariff Moves on Health Sensors. A duty drop on sensors could shave 12% off BOM cost for any health device integration.

- Draft Gen-AI Note Helper for Dietitians. Early tests show AI for nutritionists can save 30% time on diet plan documentation.

- Scout Rural Health Partners in India. Tier-II hospitals often have land but no tech-perfect to plant our NutriScan health-tech stack.

Closing Thoughts: Your Opportunity in India's Digital Health Revolution

The demand for better healthcare in India is gigantic, the ABDM digital health infrastructure is ready, and 2025 wants builders who merge health science with simple, smart health technology solutions. Bring a clear value promise-like fewer sugar spikes via your diabetes app or easier diet choices with an AI nutrition planner like NutriScan-and you can ride this Indian health-tech wave to scale and contribute to better health for millions. 🚀

FAQs for Aspiring Health-Tech Founders in India ❓

Q1: How is digital-health funding in India different from the U.S. right now?

A1: I see more focus on core care delivery solutions in India such as tele-health platforms and affordable diagnostics, and valuations feel more grounded in revenue and unit economics for health-tech.

Q2: Do I need a doctor co-founder to start a health-tech firm in India?

A2: It helps for clinical credibility, but you can set up a strong medical advisory board. Just meet Medical Council of India (NMC) guidelines and clinical establishment act rules before launch if applicable.

Q3: What data rules must a new Indian health app follow under ABDM & DPDP Act?

A3: Store Indian patient health records in India, encrypt data at rest and in transit, give users clear consent control (DPDP consent framework), maintain audit logs, and comply with ABDM data governance policy.

Q4: Which payer groups in India pay fastest for digital health solutions?

A4: Corporate employers and private insurers often settle within 45 days if you show clear ROI or cost savings in healthcare; public insurers and government health schemes take longer but cover more people.

Q5: Is hardware a must for chronic-disease startups in India?

A5: Not always. Phone cameras and open-source AI can track some vitals. Medical grade hardware helps accuracy, but partnerships with Indian medical device manufacturers or white-labeling can fill the gap if you focus on health software solutions.

ChatGPT

ChatGPT  Claude

Claude  AI Mode

AI Mode  Perplexity

Perplexity