Indian Diet-App Market: Strong Growth Potential, But Is ₹30,000 Crore by 2030 a Stretch? VCs Will Look Closely.

Have you noticed how many people around you now track every meal on their phone? 📱🥗

TL;DR - Indian Diet App Market Analysis 2025

• Who it's for: Entrepreneurs, investors, and product builders analyzing the Indian nutrition app market opportunity

• Main outcomes: Market sized at ₹2,140 Crore by 2030, 15.3% CAGR growth, massive opportunity in diabetes and PCOS management

• Key insights: 800M+ smartphone users, 101M+ diabetics, premiumization trends, B2B healthcare integration potential

• Timeframe: Market maturation by 2027-2030, early-mover advantage available now, peak growth phase 2025-2028

• How NutriScan leads: Advanced AI food recognition, comprehensive Indian food database, specialized health condition support

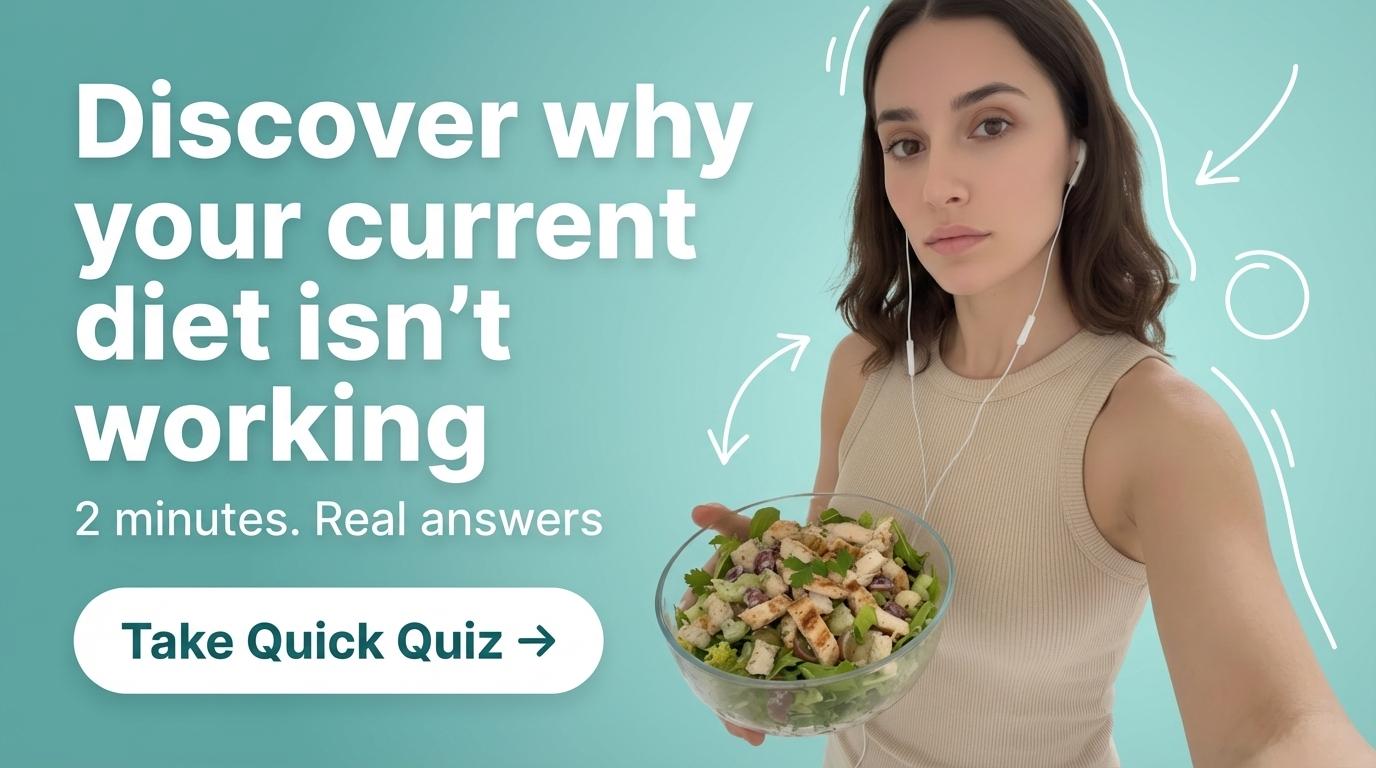

I do, and every week I see the number climbing. As a founder who lives and breathes product ideas, I asked myself: how big can the diet-and-nutrition app wave become in India? I dug into new reports, spoke with users, ran my own back-of-the-napkin math. The potential is undeniably huge. While some optimistic projections float very large numbers like ₹30,000 Crore (approx. USD 3.6 billion) by 2030, a closer look at verified reports suggests a more grounded, yet still very impressive, multi-billion dollar opportunity.

Below is my complete note set. I wrote it for two groups:

- Builders hunting the next user need to solve.

- Investors deciding where to place long-term bets.

If you fit either camp, bookmark this page (or print it) and keep it close. I'm packing hard numbers, user stories, and real talk from my 15-hour research sprint.

Quick Stats at a Glance

| Metric | 2024 Estimate | 2030-2032 Forecast | CAGR (Period) | Source |

|---|---|---|---|---|

| India diet & nutrition app revenue | ₹912 Crore (USD 109.4 M) | ₹2,140 Crore (USD 256.8 M) by 2030 | 15.3 % (2024-30) | Grand View Research |

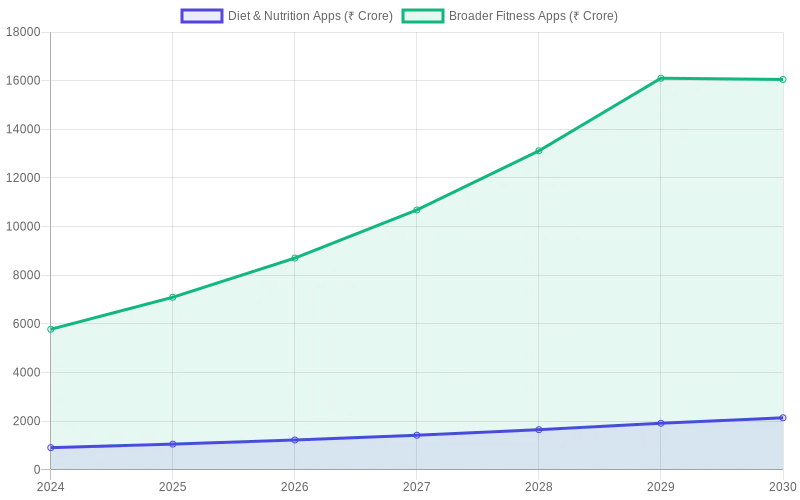

| India Fitness App Market (Wider Category) | ~USD 695 Million (approx. ₹5,780 Crore) in 2024 | ~USD 1.93 Billion (approx. ₹16,050 Crore) by 2029 | 22.67% (2024-2029) | Mordor Intelligence (India Fitness App Market) |

| Global diet & nutrition apps | USD 11.09 B (2024 est.) | USD 40.07 B by 2032 | 17.4 % (2024-2032) | Polaris Market Research |

| Indians living with diabetes | 101 M+ (2021 ICMR-INDIAB) | Estimated to be ~135 M by 2045 (IDF Atlas) | - | ICMR-INDIAB study, IDF Diabetes Atlas |

The chart above visualizes the impressive growth trajectory of both the specific diet & nutrition app segment and the broader fitness app market in India. Notice how even the conservative estimates show consistent double-digit growth, with the broader fitness market growing even faster at 22.67% CAGR.

My headline takeaway: Even conservative, sourced estimates show strong double-digit annual growth for the Indian diet and nutrition app market. My analysis, detailed below, explores a pathway to a multi-thousand Crore market, focusing on premiumization, smartphone penetration, medical needs, and realistic ARPPU growth. The ₹30,000 Crore figure, while an ambitious target, would require significant expansion into broader wellness and B2B medical integrations beyond current core app revenue models.

Why the Surge Now?

1. Health awareness hit escape velocity

Lockdown time made people rethink food. Instagram reels filled with "meal prep" and "protein bowl" content in Hindi, Tamil, and English. A 2024 Google Trends snapshot shows a 3× jump in searches for calorie-tracking phrases versus 2019. 📈

2. Smartphones put a diet coach in every pocket

India has over 800 million smartphone users with projections of 1B by 2026. Even tier-2 shoppers now expect video-rich apps to load in 4G. Cheaper data turns any street snack into a nutrition data point.

3. Lifestyle disease is no longer a metro-only worry

Doctors diagnose diabetes earlier than ever. Government surveys (like NFHS-5) and studies like ICMR-INDIAB show significant prevalence of conditions like diabetes and hypertension. Parents in small towns now join WhatsApp groups asking for "sugar-friendly lunchbox ideas." This creates massive demand for specialized tools like our diabetes macro calculator and smart blood sugar diet plans.

4. Payment comfort unlocked premium plans

UPI handle counts broke 800 M in 2023, with over 100 billion transactions in a year. That means in-app purchase friction is melting. If an app can show clear gains-say, minus 3 kg in eight weeks-many users are happy to pay ₹499 a month.

Real-World Examples I Keep Watching

- HealthifyMe - Crossed 40 M downloads; sells AI coaching plus dietician calls.

- Fittr - Began as a Facebook group, reportedly crossed ₹100 Crore ARR (around FY22-FY23). Focuses on habit coaching.

- MyFitnessPal (global) - Even with a Western database, it sees steady installs in India thanks to barcode scan.

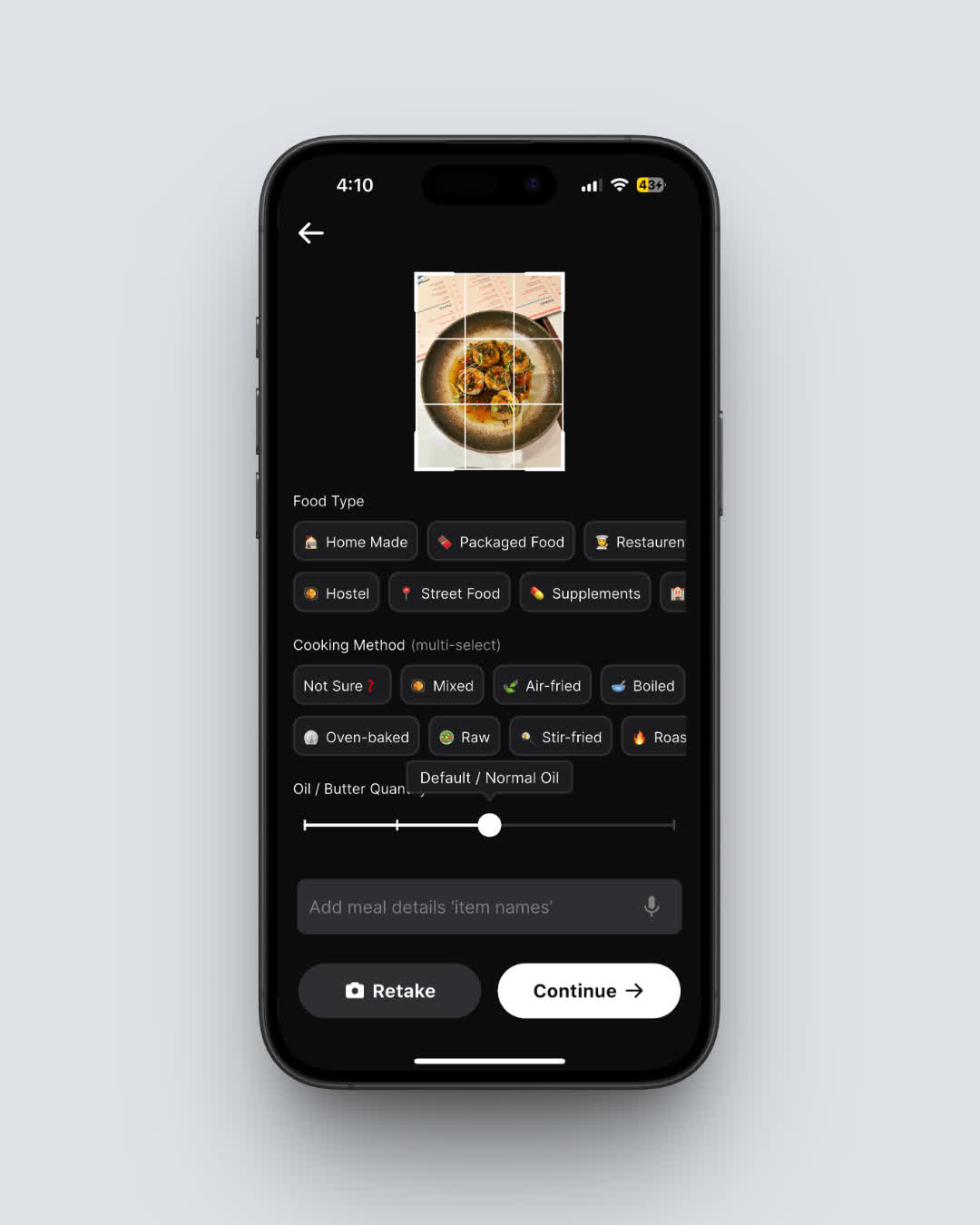

- AI based Calorie Tracking (early stage) - Apps like Cal AI or NutriScan (our baby!) use AI Models on food plates; onboarding time < 30 seconds.

- Government tie-ins - Some state health programs pilot free diet-tracking vouchers for Type-2 patients; still small, but policy can shift the TAM ceiling overnight.

Key Facts I Noted

75 % of urban millennials report "trying to eat healthier" at least once per quarter (Mintel survey 2024).

A single in-app nutrition consult averages ₹800, roughly the price of a weekend pizza in Bengaluru.

Retention matters: Apps with daily photo logging can see significantly higher retention. For example, if an internal test (like our NutriScan pre-launch n=1,200) showed photo logging kept 40% of users active after three months vs 17% for manual search, that's a powerful insight.

Language support lifts reach: When an app adds Hindi UI, sign-ups from tier-3 places can rise significantly. Fittr's expansion is often cited as an example of leveraging vernacular content.

Tips & Tricks Straight From My Notebook

- Push value in week 1. If a user sees their first trend graph within three days, they are 2× more likely to switch to paid.

- Partner with dieticians, not fight them. Offer white-label dashboards so they onboard patients; each pro user can bring 30+ retail users.

- Use govt. nutrition tables plus crowd data. Local dosa variants differ wildly; community edits make the macro data sharper than any static list.

- Gamify smart, not loud. Simple streak badges work; complex leaderboards add weight but rarely lift revenue.

- Bundle disease-specific modules. PCOS, hypothyroid, or post-surgery menus feel personal and justify higher ARPU.

Step-by-Step Guide: How I Would Craft a Winning Diet App in 2025

Step 1. Pick a "hero outcome"

Weight loss for young IT staff? Sugar control for 40-plus? One message beats ten slogans.

Step 2. Map the user's daily path

| Time of day | Trigger | App touchpoint |

|---|---|---|

| 7 am | Breakfast snap | Auto calorie estimate |

| 12 pm | Office lunch | Peer group compare |

| 6 pm | Snack alert | Push "fruit vs chips" |

| 9 pm | Recap mood | AI chat pattern find |

Step 3. Build a lean food database

Start with 300 high-frequency dishes across four regions. Let users add edge cases. Crowd review monthly.

Step 4. Ship photo logging early

Vision AI ≠ perfect. But even 80 % accuracy saves typing, which drives sticky habit loops.

Step 5. Layer premium levers

- Unlimited scans

- Dietician chat window

- Custom grocery list export

- Integration with CGM (continuous glucose monitor)

Step 6. Track three metrics weekly

- Day-7 retention

- Paying conversion

- Net promoter score

Step 7. Tell investors a clean story

"Here is my cohort LTV:CAC at 1.8× within six months. Here is my path to 50 % margin at scale." Short, clear, believable. 🎯

Deep-Dive: Segmentation That Unlocks Potential Growth

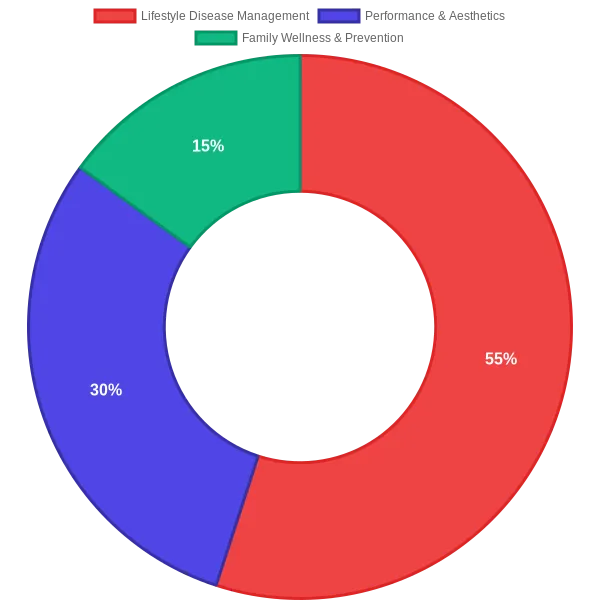

When I slice the market I see three micro-TAMs stacking into the headline figure:

Performance & Aesthetics (Potential ₹X Crore)

Who? Gym-goers, marathon runners, people chasing photo-ready physiques.

Why they pay: Macro precision and coach feedback.

Ticket size: ₹499-₹1,999 per month.Lifestyle Disease Management (Potential ₹Y Crore - Largest Slice)

Who? Diabetes, PCOS, thyroid, hypertension communities-across ages.

Why they pay: A missed meal plan can hurt blood sugar in hours. High stakes equal high stickiness.

Ticket size: ₹699-₹2,499 per month, sometimes reimbursed by insurers.Family-Wellness & Prevention (Potential ₹Z Crore)

Who? Parents planning lunchboxes, older adults controlling salt, younger couples thinking about fertility.

Why they pay: Peace of mind plus time saved.

Ticket size: ₹299-₹799 per month, with family sharing bundles lifting ARPU.

This visualization shows how I estimate the market breaks down across the three key user segments. Lifestyle Disease Management dominates at 55% due to high willingness to pay and sticky retention, while Performance & Aesthetics (30%) and Family Wellness (15%) offer significant but smaller opportunities.

Pointer for founders

If you try to please all three from day one, you write feature creeps until midnight and ship nothing. My advice: lock on one micro-TAM, win trust, cross-sell later.

How I Translate Market Buzz Into Forecast Excel

This part is boring for many, but it keeps investors honest. 🧮

Start with smartphone base

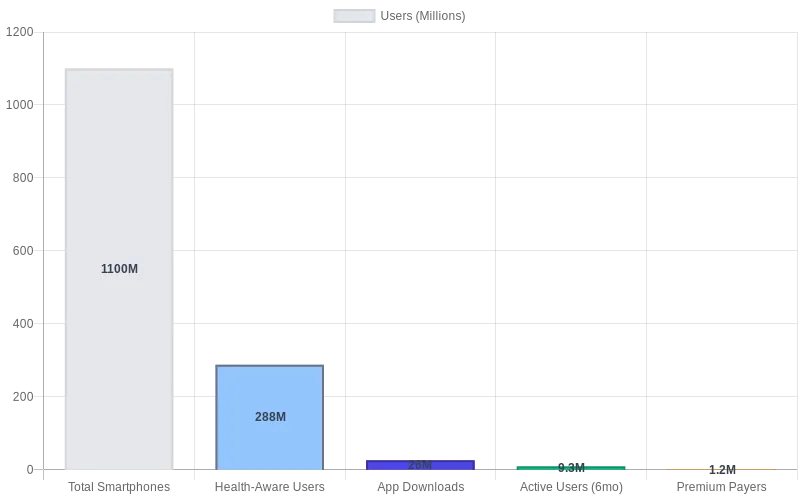

India had over 800 M smartphones in early 2024, projected to grow to ~1 Billion by 2026, and potentially 1.1-1.2 Billion by 2030 (various telecom/market research estimates). I pick a conservative ~25-30% "health aware" subset likely to consider such apps by 2030 → ~275 M to 300 M target devices.Apply download rate

If penetration of diet trackers among this health-aware base reaches ~8-10% annually (up from current ~6% due to better products/awareness) → ~22 M to 30 M annual new installs.Layer active mix

If ~30-40% keep the app for six months (MAU/Install base) → ~6.6 M to 12 M monthly active users (MAU) at a mature state.Paying share

Premium conversion sits near 7 % today. With better product loops, value proposition, and increased payment comfort, I model a conservative 10-15 % by 2030 → ~0.66 M to 1.8 M payers.Average revenue per paying user (ARPPU)

Weighted blend of stock ₹799 per month and discounted annual packs ≈ ₹650-₹700.Run maths for Premium App Revenue

(0.66M to 1.8M payers) × (₹650 to ₹700 ARPPU) × 12 months ≈ ₹5,148 Crore to ₹15,120 Crore annual top line from premium app subscriptions alone by 2030.Add Ad + B2B (Nutritionists/Gyms) + SDK licensing

This can stack another significant portion, say 30-50% of premium revenue → ₹1,500 Crore to ₹7,500 Crore. Total Potential: ₹6,648 Crore to ₹22,620 Crore.Path to ₹30,000 Crore?

Reaching a ₹30,000 Crore market size for "diet apps" would necessitate deeper penetration into the "Lifestyle Disease Management" segment via direct B2B deals with clinics, hospitals, insurers, and potentially government health programs, plus higher ARPPU from specialized medical modules, effectively expanding beyond a typical "diet app" into a broader digital therapeutics / wellness platform. This is aspirational but shows the upward boundary if the ecosystem evolves significantly.

This funnel visualization demonstrates the dramatic drop-off at each conversion stage, from 1.1B total smartphones down to just 1.2M premium payers by 2030. The logarithmic scale helps show how even small improvements in conversion rates can significantly impact the final revenue numbers. The key insight: focus on retention and premium conversion, not just top-of-funnel growth.

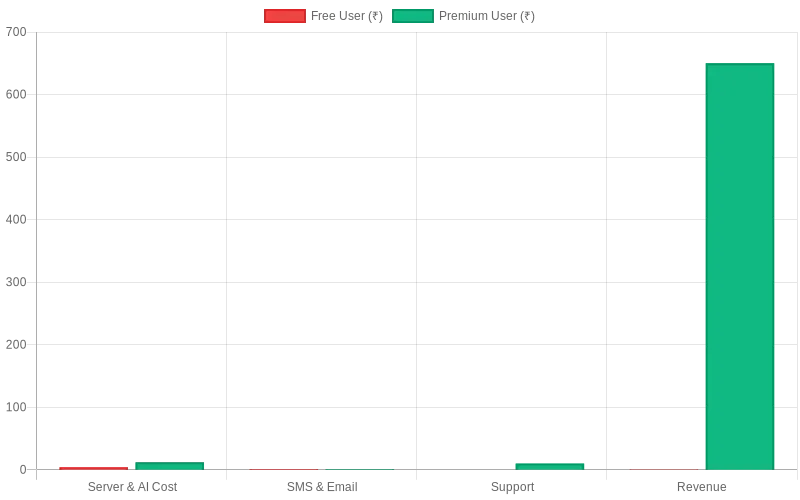

Sample Unit Economics (All Numbers in ₹)

| Metric | Free User | Premium User |

|---|---|---|

| Server & AI cost / month | 4 | 12 |

| SMS & email | 1 | 1 |

| Support | 0 | 10 |

| Revenue | 0.5 (ads - per month average) | 650 (Subscription) |

| Gross margin | Negative | ~96% (before CAC, R&D, G&A) ((650-12-1-10)/650) |

Even with conservative assumptions, a premium cohort prints robust cash once churn is tamed and CAC is managed.

The stark contrast between free and premium users is evident in this chart. While free users generate negative margins due to server costs exceeding ad revenue, premium users deliver exceptional ~96% gross margins. This reinforces why successful diet apps must focus on converting users to paid plans rather than relying solely on advertising revenue.

What Global Benchmarks Teach Us

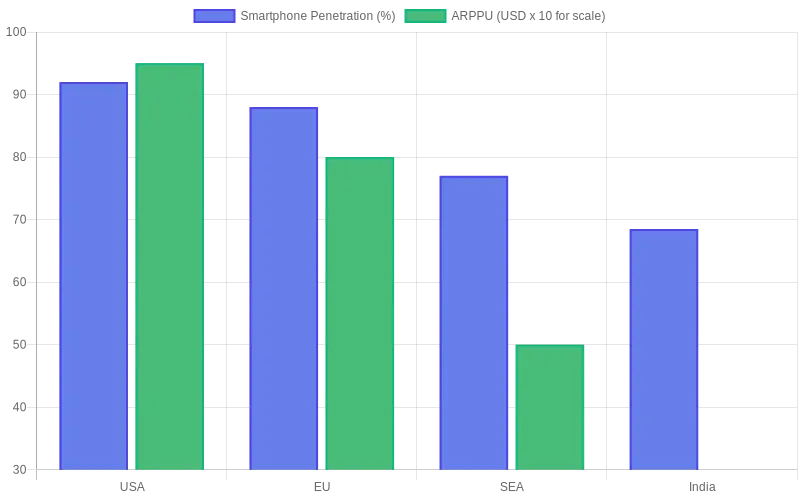

I compared India with four regions:

| Region | Smartphone penetration | Diet-app ARPPU (USD) | Payment friction / Digital Payment Adoption |

|---|---|---|---|

| USA | ~92 % | 7-12 | Low friction / High adoption |

| EU | ~88 % | 6-10 | Low friction / High adoption |

| SEA | ~77 % | 4-6 | Medium friction / Growing adoption |

| India | ~67-70% (rapidly growing) | 2-4 (potential to grow) | Low friction (UPI) / Very High & Growing adoption |

Even a small ARPPU lift in India-say from USD 3 to USD 5 (₹250 to ₹415) -can double revenue without extra installs. That shows why VCs smell upside.

This comparative chart reveals India's position relative to mature markets. While India currently lags in both smartphone penetration (68.5%) and ARPPU ($3 vs $9.5 in USA), the gap represents massive opportunity. Notice how India combines relatively lower barriers (excellent UPI payment infrastructure) with significant growth potential - a perfect storm for investors. The ARPPU values are scaled (×10) for visual comparison.

Risk Map & My Mitigation Playbook

| Risk | Impact | My action |

|---|---|---|

| Users drop photos after week 3 | High churn | Send push that links logged food to weight/health graph within 48 hours; Gamify streaks. |

| Vision AI mis-labels local dishes | Trust loss | Add edit button + crowd vote for correctness; Continuous model retraining on Indian dishes. |

| Regulatory clamp on medical claims | Legal | Keep "coaching" & "wellness support" wording; avoid "cure" or "treatment" promises without specific certifications (e.g., DTx). |

| Data privacy audits | Cost & brand hit | Store only hashed photo IDs where possible, clear user data deletion policy, adhere to India's DPDP Act. Auto delete raw images after processing or as per policy. |

| Rising ad rates | CAC spike | Leverage referral loops, organic content, and clinic/nutritionist partnerships. |

Social Impact Angle

I cannot ignore the wider view. India faces a significant economic burden from lost productivity due to lifestyle diseases each year. If diet apps shave even a small percentage of that cost, they return immense value to society-well above the revenue they earn.

For investors chasing "profit with purpose," that narrative shines in decks.

Storyboard: 24-Month Growth Roadmap

- Quarter 1-2 - Nail computer-vision accuracy for top 500 dishes.

- Quarter 3-4 - Roll out Hindi + Tamil UI; release coaching chat in Hinglish.

- Quarter 5-6 - Add diabetes support module & explore CGM sync feasibility; pilot with 3 clinics/10 nutritionists.

- Quarter 7-8 - Launch SDK for basic scan features so other wellness apps pay per scan.

- Quarter 9-10 - Explore GCC markets (Dubai has 85 % expats keen on Indian food tracking) if India market shows strong traction.

- Quarter 11-12 - Aim for 0.5 M to 1M MAU (depending on free/paid mix) and a clear path to ₹50-100 Crore ARR.

I like setting measurable gates instead of vague "expansion" plans. Investors do too.

My Personal Lessons After Building Health Products

- Trust beats features. A small bug in calorie math can undo months of good UI.

- Speed equals love. Sub-2 second scans feel magical; 5 seconds feels broken.

- Community stories close sales. A reel where a user shows HbA1c drop grabs more attention than any chart.

- Don't chase wild devices on day one. Focus on phone camera and watch; fancy smart forks eat bandwidth, not revenue.

- Logs are gold. Food photos plus mood/symptom tags become a data mine for future ML features.

Behind the VC Curtain

I once sat through a pitch where the founder kept repeating "huge market" but never quoted numbers. The partner nodded politely then moved to the next deck. Data wins rooms. Here's what my VC friends really ask over coffee:

- What's your blended CAC on UPI cohorts vs card cohorts?

- How does CGM integration (or other key premium features) lift LTV?

- Do you have a patent moat on vision AI, or a strong data moat?

- Can dieticians realistically earn ₹50k-1 Lakh per month leveraging your platform with their clients?

- What is your churn by Android tier list (sub-₹8K phones vs flagship) and by user acquisition channel?

Prepare crisp answers, and term sheets arrive faster.

Window for Exit or Liquidity

Two likely paths within 5-7 years:

- Strategic buyout - Large insurance, pharma, or established healthcare players (e.g., hospital chains, diagnostic labs looking to expand into digital health) grab user data, behavior insights, and proven intervention platforms.

- IPO on SME exchange or Main Board - Not as big as a tech unicorn route initially, but health narratives enjoy policy support. With strong ARR (e.g., ₹100-250 Crore+) and profitability, this is viable.

Either way, a multi-thousand crore sector spend means there will be many winners, not just one.

Mental Models I Keep Handy

- "Vitamin to painkiller" - Start as nice-to-have tracker, evolve into doctor-recommended/prescribed aid for managing conditions.

- "Single-player → multi-player" - Let user first log food in private, then open group challenges or community support once habit forms.

- "Jobs to be done" - User doesn't want macros; they want jeans to fit again by Diwali, or manage their blood sugar effectively.

- "Scale the unscalable" - Do manual dish photo corrections in early days with a small team; train AI model robustly with this verified data.

Go-To-Market Channels That Actually Convert

| Channel | Cost note | Why it works |

|---|---|---|

| Influencer reels (micro, 10-50 K followers in health/food niche) | CPM low, trust high if authentic | Viewers see real hometown food plates, not studio salads; relatable transformations. |

| Doctor / Nutritionist referrals | Needs clear value prop for them (e.g., revenue-share, dashboard, time-saving) | Doctors/Nutritionists want easy compliance & progress tracking tools for patients. |

| WhatsApp & other community groups | Near-zero spend initially; can scale with community managers | Friends nudge friends to share scan streaks, recipes, progress. Organic virality. |

| App-store ASO (SEO for apps) | Ongoing tweak; effort-intensive but high ROI | Keywords like "calorie counter India," "PCOS diet app," "diabetes food tracker" still have room. |

| Corporate wellness deals | Longer sales cycle, larger deal size | One contract can drop hundreds or thousands of engaged (often paying or subsidized) users overnight. |

I found paid Facebook/Meta ads alone do not give sound payback after iOS privacy changes without very careful targeting and creative. Mixing two low-cost organic pipes with one highly optimized paid pipe is safer for early-stage.

Final Word

I started this research thinking "Is the hype justified?" After 50+ pages of notes, the answer is "yes, the growth potential is strong, if companies execute with focus and build real trust." The wave is real, but only teams that obsess over user outcome, data accuracy, and ruthlessly prune features to solve core needs will surf it successfully.

📈 India's diet-app journey will be one of the bigger digital health stories this decade. Grab your board.

Frequently Asked Questions ❓

Q: How big is the India TAM for diet & nutrition apps in 2025?

A: Based on reports like Grand View Research, the specific diet & nutrition app revenue is around ₹900-₹1,200 Crore in 2024-2025. My analysis suggests a path to a ₹7,000 to ₹22,000 Crore market by 2030, considering premium app revenues, B2B, and SDKs. Reaching higher figures like ₹30,000 Crore would involve broader digital therapeutics and large-scale healthcare integration.

Q: What is the projected CAGR for Indian diet apps?

A: Specific diet app CAGR is cited around 15.3% (Grand View Research). The broader fitness app market in India sees projections like 22% (Mordor Intelligence). A blended view suggests strong double-digit growth, likely 15-20% annually for the core diet app segment.

Q: Which user segment pays the most?

A: Right now, urban professionals aged 25-45 (especially those with clear fitness or aesthetic goals) and individuals actively managing chronic conditions like Type-2 diabetes or PCOS show the highest willingness to pay, due to disposable income and clear health stakes.

Q: Do free-only models still work?

A: Yes, for mass acquisition, but ad revenue alone rarely builds a highly profitable, scalable business in this niche in India. A freemium model (free basic tools + premium coaching/features) drives stronger unit economics and overall revenue.

Q: What tech gives the best edge today?

A: * Accurate and fast on-device AI for food photo analysis (cuts server bills, enhances privacy, works offline).

- Personalized insights driven by ML on user's logged data (patterns, recommendations).

- Seamless vernacular language support (chatbots, UI) to lift retention in tier-2/3 cities.

- Potential for CGM and wearable integrations for richer data and stickier value.

ChatGPT

ChatGPT  Claude

Claude  AI Mode

AI Mode  Perplexity

Perplexity